Two narratives dominated last week’s economic discussion. First, as the Beige Book from the Federal Reserve Board stated, the economy “continued to increase at a modest to moderate pace in January and early February.” In his congressional testimony, Chairman Ben Bernanke was also quick to cite the important role that manufacturing has played in the recent rebound, with higher levels of activity reported in most areas of the country. Indeed, regional surveys from the Dallas and Richmond Federal Reserve Banks observed greater production activity and increased optimism for the next six months.

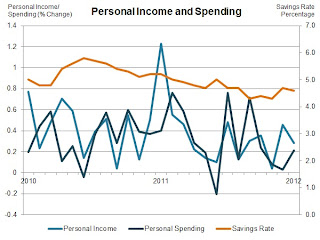

This upbeat assessment is shared by business economists at the National Association for Business Economics, who see a stronger outlook. Their consensus estimates for real GDP growth for this year and next are 2.4 percent and 2.8 percent, respectively. Adding to this sentiment, the Bureau of Economic Analysis (BEA) revised its estimates for fourth quarter 2011 growth up from 2.8 percent to 3 percent, led by increased consumer spending and business inventory accumulation. BEA also reported modest growth in personal income and spending for January, with strong gains in durable goods purchasing. Consumers, too, are more confident, according to the Conference Board, with their sentiments about the current and future economy at their highest level since this time last year.

In contrast to the more positive tone of many of these studies, the second narrative of last week focused on a series of indicators that unexpectedly declined. Most of us were anticipating growth for the Institute for Supply Management’s purchasing managers index, but it declined from 54.1 in January to 52.4 in February. This was led by a slower pace of growth for new orders, with production and employment also easing. Likewise, the Census Bureau reported reduced durable goods orders and construction spending in January.

In each of these cases, the longer-term trend remains a positive one and is in line with the first narrative. November and December figures were sharply higher, and so it might be expected to have some easing afterwards. Growth should resume in the coming months, especially as industrial production should grow around 4 percent this year. Even with that said, it is also clear that manufacturers are closely watching the events of Europe, once-again resurgent energy and raw material prices, and policy actions stemming from Washington. They remain cautious that one of these headwinds might derail growth, even with higher optimism overall.

This week, everyone will be focused on Friday’s jobs numbers. With 82,000 net new jobs created in the past two months, I anticipate continued improvements in employment for the sector, but perhaps not as large as were seen in November and December. Other key indicators of note include the release of revised productivity data on Wednesday and international trade findings on Friday.

Chad Moutray

Chief Economist

National Association of Manufacturers

Chief Economist

National Association of Manufacturers

US FACTORY ORDERS FELL 1 PERCENT IN JANUARY

Today in Manufacturing

Today in Manufacturing

The decrease was largely expected after a tax cut expired at

the end of last year, but demand is now just 4.6 percent below the peak set in

June 2008 ... continue

So-called "geek culture" is becoming mainstream,

slowly but surely, but there's still too much resistance if we want to inspire

swaths of young engineers... continue

'JOB CREATION' DRIVING HIGHWAY BILLS IN CONGRESS

Today in Manufacturing

'JOB CREATION' DRIVING HIGHWAY BILLS IN CONGRESS

Today in Manufacturing

The lure of roads, bridges, buses and trains isn't enough

anymore to drive an expensive transportation bill through

Congress... continue

CHINA AIMS TO

BOOST DOMESTIC CONSUMPTION

Today in Manufacturing

Today in Manufacturing

China's premier on Monday called for a boost in domestic

consumption to keep the economy expanding while overseas markets remain weak …

continue

|

Quick Manufacturing News

The

proposed budget of $8.344 billion for EPA is $105 million below the agency's

enacted level for FY 2012. The budget focuses on what the agency describes as

core environmental and health protections, such as safeguarding Americans

from pollution in the air they breathe, the water they drink and the land

where they build their communities. Click to continue

|

|

Quick Manufacturing News

Fake

goods include counterfeit Coach, Burberry, Louis Vuitton and Gucci handbags,

fake Nike shoes, and cigarettes. Click to continue

|

|

Quick Manufacturing News

'Everyone

agrees that there is a critical need for Congress to pass this important

legislation,' NRF senior vice president for Government Relations David French

said. 'We cannot continue down a path of short-term extensions that provide

less and less certainty to the highway programs. Congress must act now to

provide certainty and to allow U.S. companies to remain competitive on a

global basis.' Click to continue

|

No comments:

Post a Comment